The Benevolence of Microfinance

- Aug 3, 2021

- 2 min read

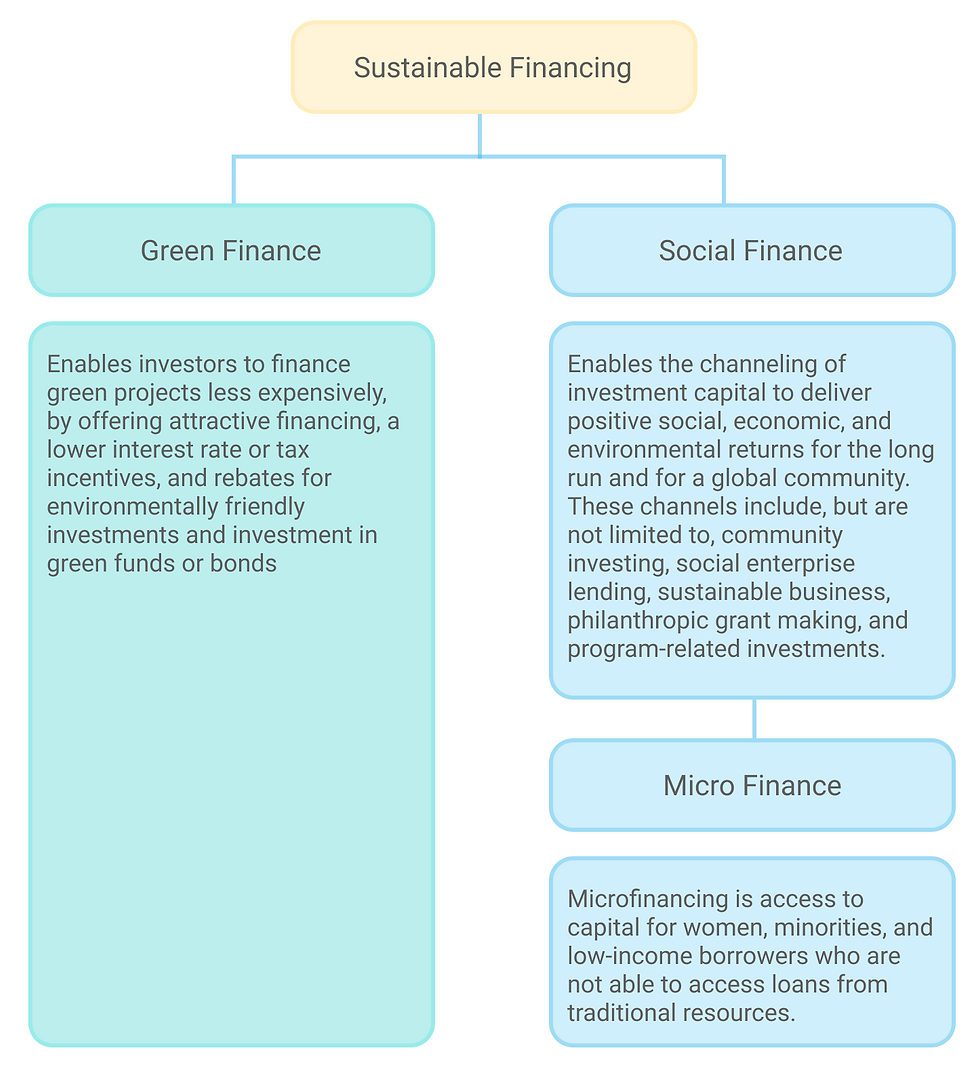

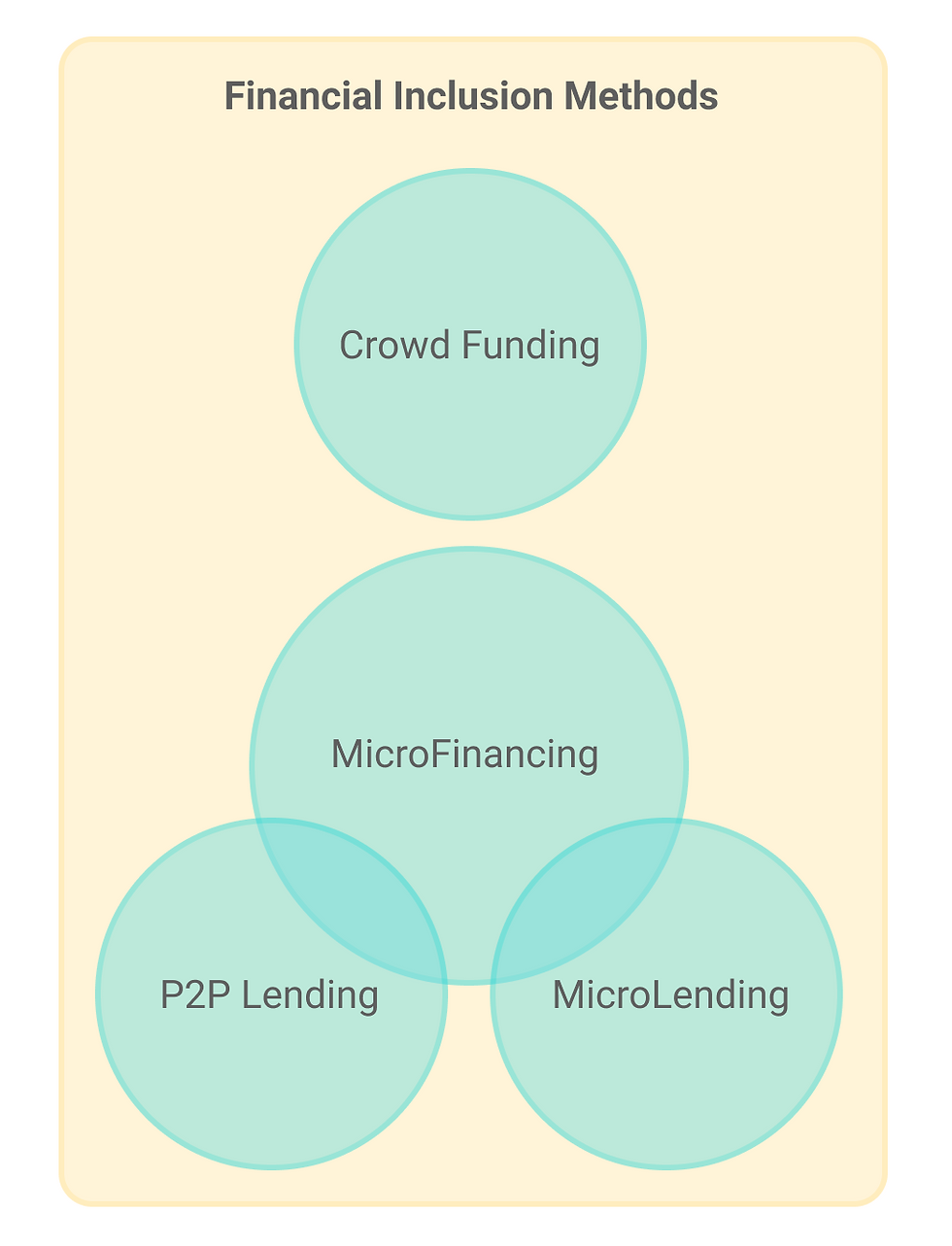

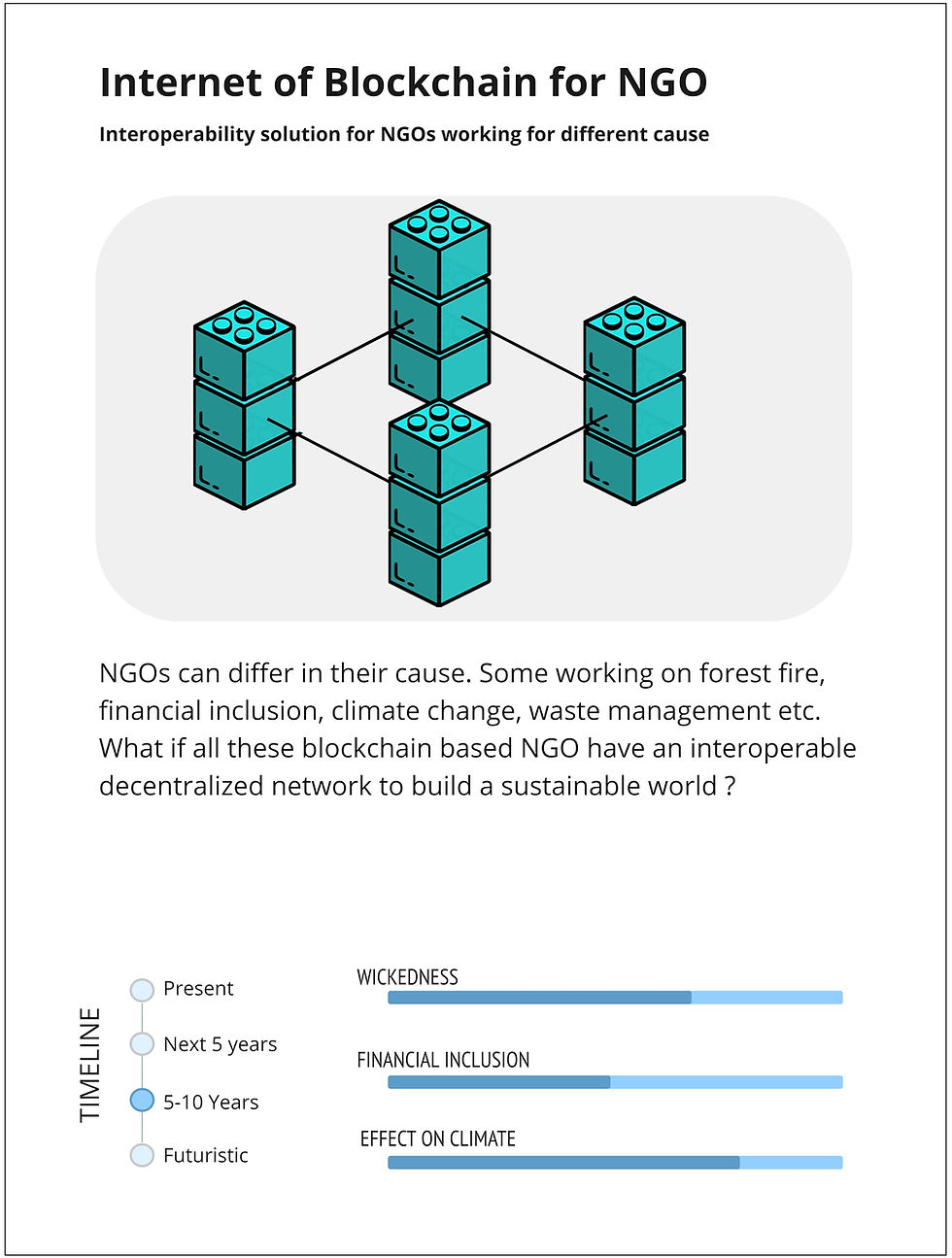

We were intrigued by the topic of microfinance and its potential in distributing financial resources in a uniform manner reaching the last mile community.

Microfinance is a banking service provided to unemployed or low-income individuals or groups who otherwise would have no other access to financial services.

Microfinance allows people to take on reasonable small business loans safely, and in a manner that is consistent with ethical lending practices.

The majority of microfinancing operations occur in developing nations, such as Uganda, Indonesia, Serbia, and Honduras.

Like conventional lenders, microfinanciers charge interest on loans and institute specific repayment plans.

The World Bank estimates that more than 500 million people have benefited from microfinance-related operations.

Case Study of Grameen Bank

Grameen Bank originated in 1976, in the work of Professor Muhammad Yunus at University of Chittagong, who launched a research project to study how to design a credit delivery system to provide banking services to the rural poor. In October 1983 the Grameen Bank was authorised by national legislation to operate as an independent bank.

The bank grew significantly between 2003 and 2007. As of January 2011, the total borrowers of the bank number 8.4 million, and 97% of those are women. In 1998 the Bank's "Low-cost Housing Program" won a World Habitat Award. In 2006, the bank and its founder, Muhammad Yunus, were jointly awarded the Nobel Peace Prize.

The Grameen Bank has four administrative tiers, each with a distinct set of functions: the head office, the zonal office, the area and the branch. The zonal and area offices together are referred to as the regional offices.

Modern Day Micro Finance Institutes (MDMFI) uses alternative data, specifically mobile phone data from smartphones, as the underlying source and foundation of their credit solutions.

Comments